Finally, if you have already got a loan and your property price drops such that your LTV exceeds your lender’s boundaries, that’s usually not an issue, as most residence loans aren’t callable, that means the lender can’t need repayment before the stop of the loan phrase.

Every single lender and loan form has its own limitations and limitations, which includes for borrowers’ LTVs. Some even have a number of thresholds—an absolute highest plus a optimum needed to steer clear of supplemental protections which include house loan insurance, for instance.

If you are authorized, make use of your funds to protect all your expenditures now, and pay out the lender again month by thirty day period

So So how exactly does it function? Any time you submit an software at Acorn Finance you are opening the doorway for several top-rated lenders to ship you competitive individual loan provides.

The Loan To Value isn't the only thought whenever a lender decides on home finance loan eligibility. They'll also have a look at credit rating score and housing ratios among Other individuals to determine their possibility in lending cash.

It’s also a good idea to submit an application for prequalification with many lenders before you create a final final decision. Prequalification allows you to preview your opportunity charge and Evaluate loan features with out a tricky credit inquiry.

BHG Money requires a bare minimum credit rating score of 660. Even so, the lender does say it considers other aspects Moreover your credit history rating when building a lending final decision.

LTV is also important because, if you’re buying a residence as well as the appraised price of the house turns out being considerably lessen than the acquisition value, you may need to help make a larger deposit so that the LTV click here doesn’t exceed limitations established by your lender.

The loan-to-worth ratio is a straightforward formula that measures the quantity of funding utilized to purchase an asset relative to the worth of that asset. In addition it reveals the amount of fairness a borrower has in the house they’ve borrowed versus—just how much dollars could well be still left when they sold the house and paid out from the loan.

If you discover facts or calculations you believe being in error, remember to Call us. Marketed premiums and phrases are matter to change without warning.

It's also possible to prequalify on the internet or around the cell phone to gauge your approval odds. To accomplish this, you’ll need to offer your individual data and income.

The duration of the appliance process may differ from lender to lender. Some economical establishments deal with your complete transaction on the internet and can present you with a lending determination Nearly right away.

When credit rating unions may provide great charges, they may be tough to qualify for. Most credit score unions have to have borrowers to obtain excellent to excellent credit rating. On top of that, their software and approval method might take extended than financial institutions and on the net lenders.

Paying down your loan’s principal harmony may also decrease your LTV. And if your own home increases in price, which will decreased your LTV, as well.

Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Bug Hall Then & Now!

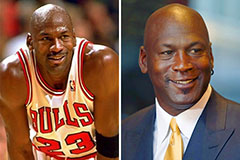

Bug Hall Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now!